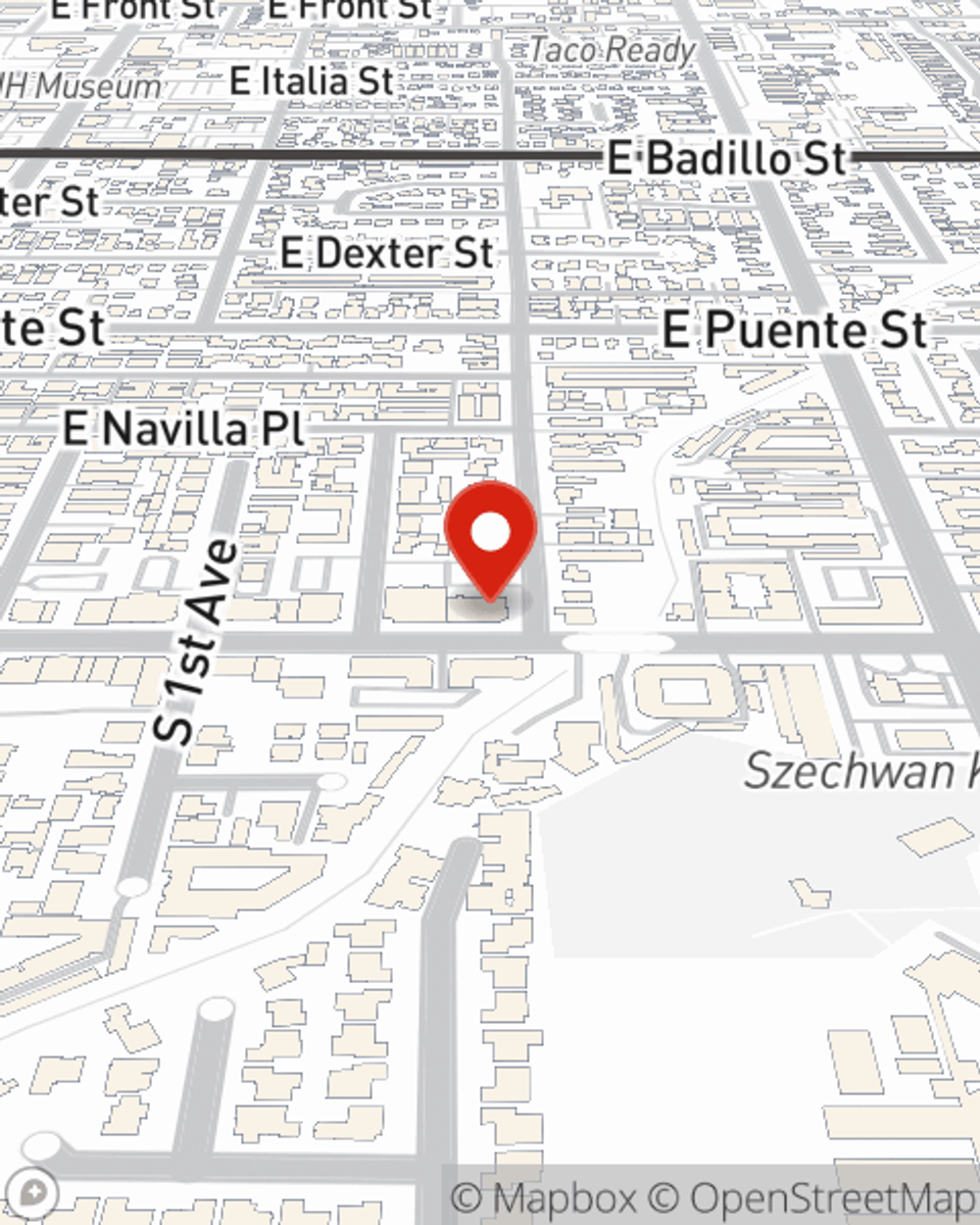

Life Insurance in and around Covina

Get insured for what matters to you

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- Los Angeles, CA

- Long Beach, CA

- Anaheim, CA

- Santa Ana, CA

- Riverside, CA

- Irvine, CA

- Glendale, CA

- Huntington Beach, CA

- San Bernardino, CA

- Fontana, CA

- Oxnard, CA

- Glendora, CA

- Azusa, CA

- San Dimas, CA

- Rancho Cucamonga, CA

- Ontario, CA

- Corona, CA

- Santa Clarita, CA

- Pomona, CA

- Torrance, CA

- Pasadena, CA

- Fullerton, CA

- Orange, CA

- West Covina, CA

Be There For Your Loved Ones

State Farm understands your desire to help provide for your loved ones after you pass away. That's why we offer excellent Life insurance coverage options and reliable empathetic service to help you select a policy that fits your needs.

Get insured for what matters to you

Don't delay your search for Life insurance

Put Those Worries To Rest

When it comes to opting for your Life insurance coverage, State Farm can help. Agent Matt Davenport can assist you as you take a look at all the factors that go into the type and amount of insurance you need. These components may include your age, how healthy you are, and sometimes even occupation. By being aware of these elements, your agent can help make sure that you get a personalized policy for you and your loved ones based on your individual situation and needs.

Looking for a life insurance option that even those who thought they couldn't qualify could benefit from? Check out State Farm's Guaranteed Issue Final Expense. It can prove useful to cover final expenses, such as medical bills or funeral costs, without weighing down your loved ones. Contact your local State Farm agent Matt Davenport for a free quote on Guaranteed Issue Final Expense..

Have More Questions About Life Insurance?

Call Matt at (626) 515-7007 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Matt Davenport

State Farm® Insurance AgentSimple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.